Interest in healthcare real estate experienced tremendous growth in recent years. In 2018, an investment volume of €945 million broke all records. According to current forecasts, this trend will continue and the total investment volume will exceed one billion euros in 2019. Demographic trends and the current healthcare system in the Netherlands make healthcare real estate a future-proof investment category.

There is particular focus on private care initiatives. Investors, healthcare operators and property developers therefore see many opportunities. From redevelopment projects to acquisitions of existing care homes. In 2019, Crowdrealestate has already placed five of these projects with great success. Interest from the crowd is high. All these projects were fully subscribed within less than a day. Projects in the Netherlands, but also in Germany.

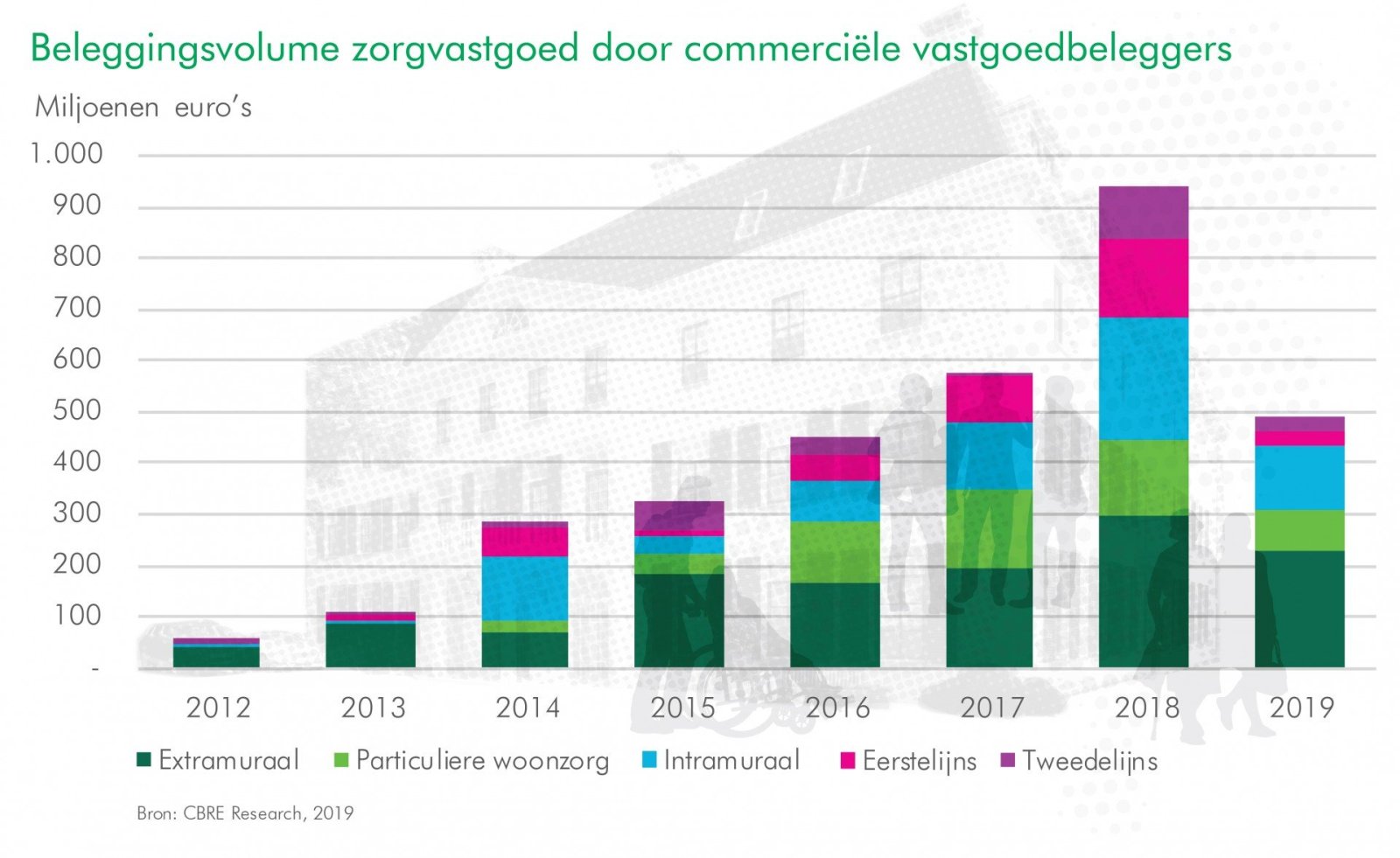

The graph above shows that the amount invested by investors in healthcare real estate has increased significantly in recent years. In 2012, invested assets in this category were still around 50 million euros, in 2009, healthcare real estate was even a barely existing sector in the Netherlands. In the first six months of 2019, 489 million euros were already invested, which is 25% more than in the first six months of 2018.

The increased interest has largely to do with the growing number of over-75s. From that age onwards, demand for adapted housing increases sharply. The Netherlands has some 1.3 million people in this category. It is estimated that this number will grow to 2.1 million by 2030. Privatisation in healthcare also plays a major role. Senior citizens are increasingly living at home and the classic care home will virtually disappear in the coming years. Only those requiring very heavy care will still qualify for admission to a nursing home. Moreover, the wishes of the over-75s are changing. They do not always feel at home in a large-scale complex and are looking for an environment they can decorate according to their own taste and where they have contact with neighbours. Developers are therefore coming up with various small-scale housing options for seniors. The projects recently placed by Crowdrealestate Care flats Steyl and residential care centre Parkhuys are good examples.

However, supply still lags far behind demand. The Netherlands needs at least a thousand new care locations. This is according to an estimate by CBRE, partly based on the current shortage of 80,000 senior housing units, the current waiting lists for intramural care housing and the need for first- and second-line care providers to cluster in health centres.

The need for good healthcare real estate will therefore continue to grow. Due to growing user demand and the interesting risk-return ratio, the number of investors in the market is growing. In addition, more and more collaborations between healthcare parties and market players are emerging and new (healthcare) initiatives are being developed. It is expected that more new-build developments and redevelopments of care complexes will enter the market compared to previous years. Currently, Crowdrealestate has several healthcare real estate projects in preparation and in all likelihood many more will follow.

Sources: https://fd.nl/ondernemen/1286573/vergrijzing-trekt-beleggers-aan-in-het-zorgvastgoed, https://nieuws.cbre.nl/1000-nieuwe-locaties-nodig-zorgvastgoed/, https://fd.nl/achtergrond/1287619/wie-bouwt-de-nodige-verpleeghuizen