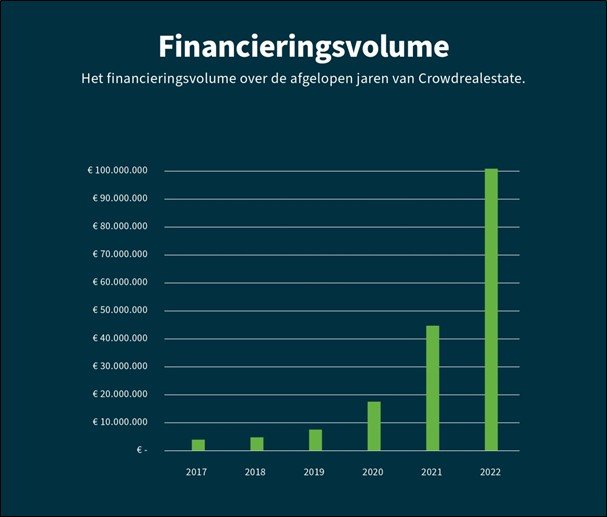

Crowdrealestate grew strongly in 2022. For instance, the funding volume has more than doubled and more than €100,000,000 has been funded by 2022. There are also no arrears or defaults within the loan portfolio to date. In this article, you will find the key statistics for the past year.

Funding volume more than doubled in the year 2022 compared to 2021. Thanks to this strong growth, Crowdrealestate has funded more than EUR 100 million in 2022. This through a nice range of crowdfunding projects, private placements and 1-to-1 financings.

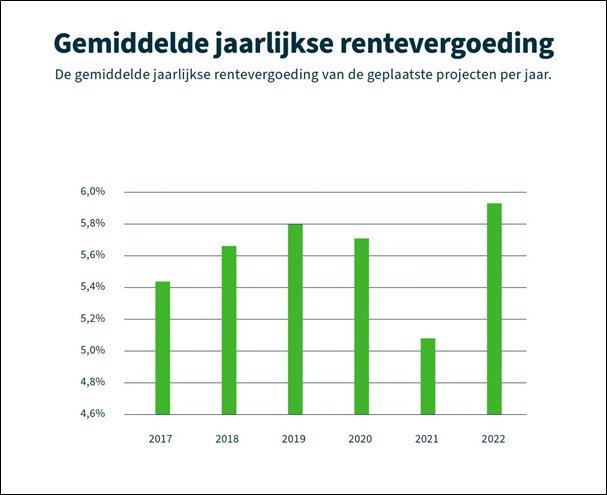

The average annual interest rate increased by about 0.8% in 2022 compared to last year. This broke the downward trend since 2019. The average interest rate is expected to increase further next year. Due to the absence of defaults and arrears within the loan portfolio, the difference between gross and net yield is minimal.

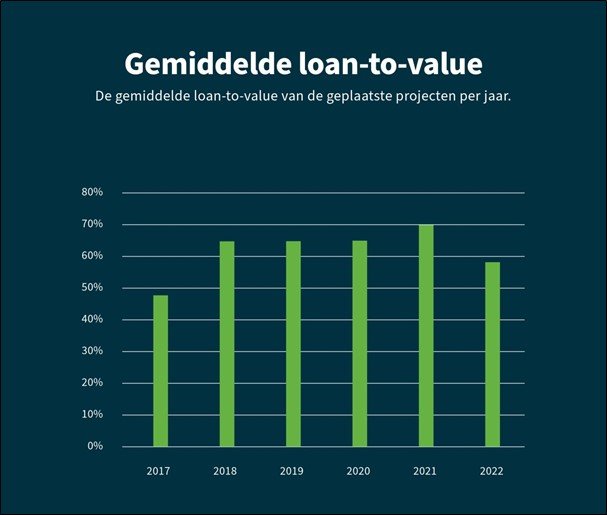

The average loan-to-value of the placed projects decreased from 70% to only 58% by 2022. This is based on the appraised market value at the start of the placed real estate projects. Next year, Crowdrealestate aims for an average loan-to-value of the same level.

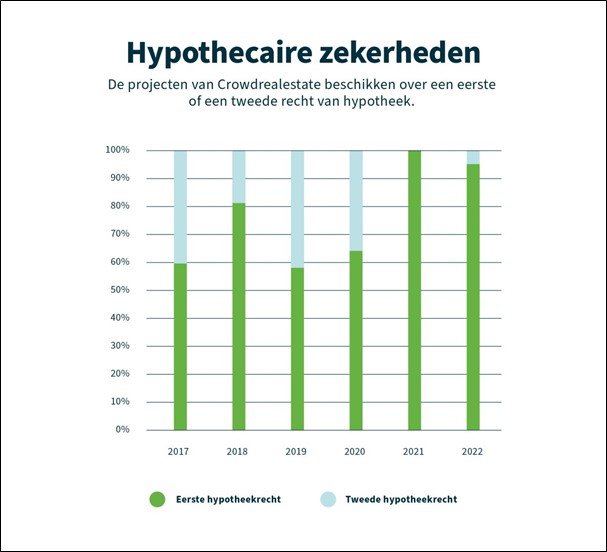

All of Crowdrealestate's projects have mortgage collateral. Crowdrealestate mainly publishes real estate projects with a first-right mortgage as security. In 2021, this percentage was as high as 100% and in 2022 as high as 95%. The focus will remain the same next year.

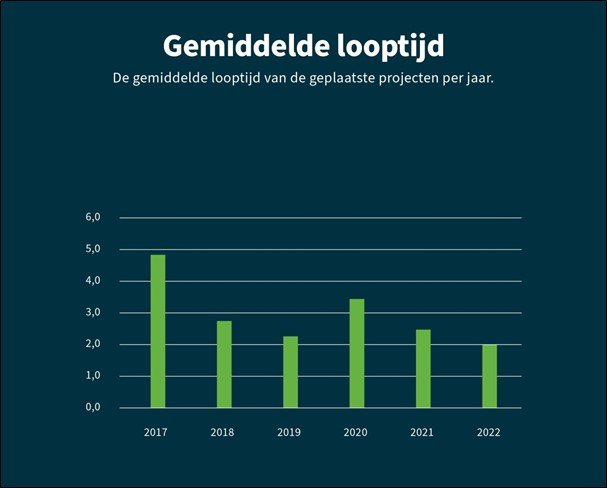

The target duration of Crowdrealestate's placed propositions averaged 2 years in 2022. Last year it was 2.5 years and in 2020 it was around 3.5 years. The average duration of all Crowdrealestate's placed projects is currently 2.7 years.

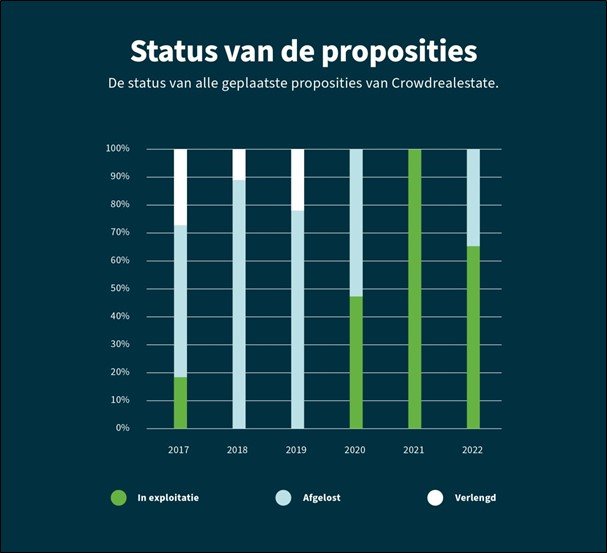

This chart shows the status of placed projects by year. Most of the projects placed in 2017, 2018 and 2019 have been repaid. This is in line with the average maturities of the projects. Crowdrealestate's intention is to reduce the percentage of extended projects to 0% by early 2023.

This chart shows the status of placed projects by year. Most of the projects placed in 2017, 2018 and 2019 have been repaid. This is in line with the average maturities of the projects. Crowdrealestate's intention is to reduce the percentage of extended projects to 0% by early 2023.

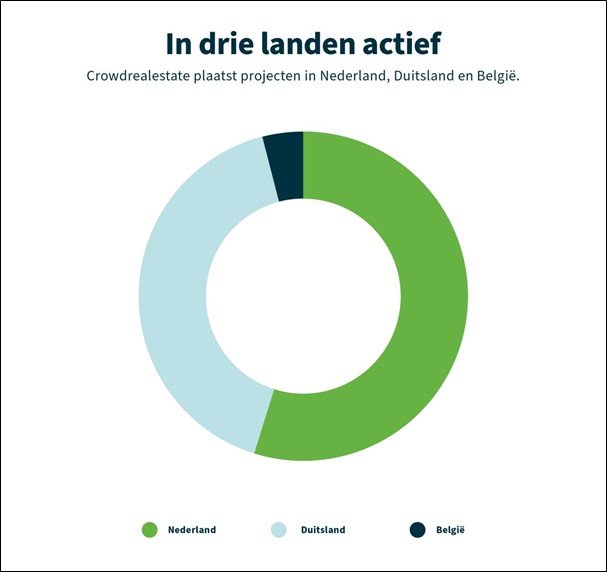

Crowdrealestate has been funding projects in the Netherlands, Germany and Belgium since its inception. Most of the projects are located in the Netherlands. Crowdrealestate will not expand to other countries in the coming year.

To date, Crowdrealestate has no arrears and no defaults within the loan portfolio. The enforcement of mortgage collateral has therefore not yet been an issue.